Greece’s financial crisis emerges in Epstein files

Newly released Jeffrey Epstein files, made public by the U.S. Department of Justice, contain extensive references to Greece’s economic crisis, particularly during the peak years between 2012 and 2015.

Within the archive—comprising approximately 3.5 million documents—the word “Greece” appears 1,553 times, highlighting the country’s central role in financial analyses conducted during the height of the Eurozone debt crisis.

Bailouts, Banks, and Sovereign Debt

The documents frequently address key issues such as Greek bailout programs, the banking system, public debt, currency and debt swaps, bank recapitalization, and Greek government bonds. During this period, Greece was viewed by international financial circles as both a high-risk economy and a potential investment opportunity.

Crisis, Referendum, and Political Turmoil

The files also include detailed assessments of the political crisis and referendum of summer 2015. In email exchanges between Jeffrey Epstein and renowned linguist and intellectual Noam Chomsky during June–July 2015, it is stated that nearly 90% of the financial aid provided to Greece ultimately flowed back to German and French banks.

Chomsky characterizes Greece’s debt as “odious debt,” arguing that it should be restructured or canceled. Epstein, in response, offers a technical analysis of the banking system, asserting that bailout packages primarily served to protect creditors rather than the Greek economy.

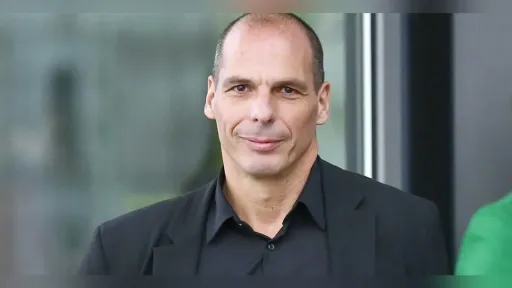

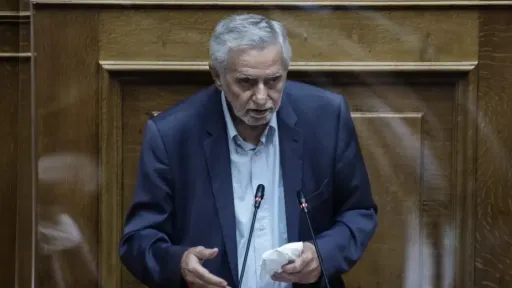

Tsipras–Varoufakis Rift Documented

The documents also shed light on tensions between then-Prime Minister Alexis Tsipras and Finance Minister Yanis Varoufakis. A July 6, 2015 email notes that following Varoufakis’ resignation, Euclid Tsakalotos was expected to assume the finance portfolio—an internal shift believed to buy Tsipras time ahead of a critical Eurozone summit.

Epstein comments that this change may have complicated rather than eased Greece’s negotiating position.

Greek Banks and Investment Strategies

Greek banks receive dedicated attention in the Epstein files. Correspondence from 2013–2014 examines bank warrants, non-performing loans, the PSI debt restructuring process, and the Greek state’s 35%–70% ownership stakes in major banks. Alpha Bank is repeatedly cited as a standout investment candidate.

Additionally, short-term Greek government bonds are described as attractive investment instruments, despite their low liquidity.

Greece Labeled a “Systemic Risk”

Investor briefing documents from 2012 characterize Greece as a systemic risk to the global financial system, with particular emphasis on the potential consequences of a Greek exit from the Eurozone and its ripple effects on international markets.

The released files make clear that Greece’s presence in the Epstein documents was far from incidental. Instead, the country was closely monitored, analyzed, and targeted for investment strategies by global financial actors throughout its years of economic turmoil.

Gündem